JPEX傳無法提取資金 證監重申未獲發牌 指或涉詐騙已轉介警方 (持續更新)

2023-09-15 17:41:00

日前香港證監會(SFC)發新聞稿,點名JPEX交易所並非持牌實體,且並無向證監會申領在香港經營虛擬資產交易平台的牌照。其後JPEX一度傳出8小時內無法出金(提取資金),甚至有用戶在網上反映,JPEX將提款額度被限制了最高1000 USDT美元穩定幣、提幣手續費改至999 USDT,意味着散戶最多僅能出金1美元。

【17:37更新】最新警方商業罪案調查科表示正跟進事件。

證監會:JPEX從未與證監會接觸

最新證監會回覆表示,自證監會於9月13日就JPEX發出警告聲明以來,JPEX從未與證監會接觸。JPEX的聲明,以及對客戶提款的所謂安排或要求,全屬JPEX自行作出。

證監會重申,JPEX集團旗下的實體一概沒有獲證監會發牌,迄今亦無向證監會申領在香港經營虛擬資產交易平台的牌照。

由於事件可能涉及詐騙,證監會已將案件轉介警方,並會協助警方調查。

商罪科:已接獲證監會轉介及正跟進事件

警方周五(15日)下午亦發聲明,指證監會於9月13日發出警告聲明,指稱一個虛擬資產交易平台旗下實體未獲證監會發牌。警方昨日(9月14日)已接獲證監會轉介,商業罪案調查科正跟進事件。

警方呼籲,所有關於證監會聲明中的虛擬資產交易平台的投訴,可以電子報案方式向警方舉報,商業罪案調查科將會一併處理。

若市民有查詢,可致電警方24小時熱線2860 5012。

JPEX:已就此成立專案小組調整

JPEX周四(14日)就事件發公告回應,表示已於9 月14日凌晨進行USDT提幣手續費的調整。就上述事項,平台已經就此成立專案小組,成員將由專業的法律界人士、金融界別精英所組成並商討未來的發展方向以進行調整,並等待證監會回覆進一步的指引。

平台又指,將依據證監會的回覆,於不日逐步調整提幣手續費,並階段性開放提幣上限;同時提供表格,供有緊急的提幣需求的用戶,以申請優先的提幣排序提幣,並表示「將會儘速進行安排,以解決具有特別需要的用戶」。

網傳JPEX交易所8小時未出金

據網上有用戶反映,周三(13日)得悉證監會點名的公告後,已立即從JPEX的錢包中申請出金,但苦候8小時仍未能提取金錢。亦有用戶在網上反映,JPEX將提款額度被限制了最高1000 USDT美元穩定幣、提幣手續費改至999 USDT,意味着散戶最多僅能出金1美元。網上有KOL網紅公開展示成功提取金額的照片,據照片所見,該網紅成功提取1美元。

另據網絡作家「千頌C」指,於新加坡亞洲crypto峰會「Token 2049」上,作為鉑金贊助商之一的JPEX今日未有職員上班;至於有網紅的加密貨幣找換店,傳有多位用戶上門查詢。

JPEX交易所疑正轉移資產

證監開名後,JPEX交易所疑正轉移資產。網上流傳截圖,指JPEX已開始轉出多筆大額交易到新開地址,凌晨更出現一筆超過100萬美元(折合約782萬港元)的交易。現時JPEX仍可於Apple的App Store及Google Play商店下載。

JPEX確認平台未遞交牌照申請

JPEX同日發聲明處理文件需時,確認平台未遞交牌照申請,又批評證監會的聲明無意營造對加密貨幣企業友好的環境。至於網紅林作則在自己的社交平台表示,無意觸犯證監會規定,他說不會再公開推廣或提及任何未有在香港申請牌照的交易平台。

證監會早前亦公布,接獲部分散戶投資者投訴未能從平台戶口提取資產。

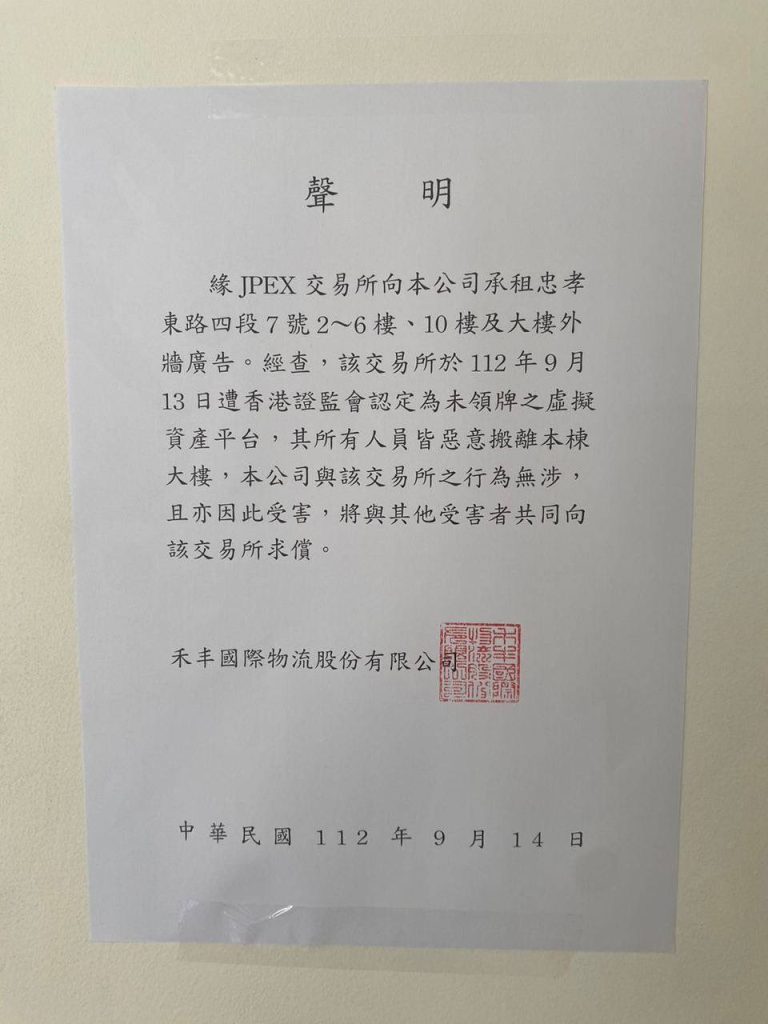

JPEX實際負責人及辦公地點成謎

綜合多間早前調查,平台於多國均有註冊公司,當中香港、澳洲的公司已遭證監會點名,香港公司列在證監會的在「無牌公司及可疑網站名單」;美國及加拿大均有註冊公司,惟未有交易所牌照;位於立陶宛的公司則已撤銷註冊。

證監會質疑涉詐騙 商罪科跟進查JPEX

2023年9月16日

證監會周三(13日)點名警告虛擬資產交易平台JPEX集團旗下的實體概無獲證監會發牌或申牌後,該平台於翌日大幅調高提幣手續費,大批用戶變相無法提款。證監會周五(15日)表示,由於事件可能涉及詐騙,已把案件轉介警方,並會協助警方調查。警方指出,商業罪案調查科正跟進事件,呼籲所有相關投訴可透過電子報案方式向警方舉報,商業罪案調查科將會一併處理。

SFC:點名警告後未曾接觸

JPEX遭證監會點名警告後,周四曾把提幣手續費調升至999USDT(泰達幣,1USDT大約等於1美元),提款額度上限設為1000USDT,即每次實際只可提出1USDT,大批用戶憂成苦主。JPEX當晚聲稱,將依據證監會的回覆於不日逐步調整手續費並階段性開放提幣,如有緊急提幣需求可填寫表格,將會盡速安排;又指正等待證監會回覆進一步指引。

不過,證監會發言人周五反駁,自證監會於9月13日就JPEX發出警告聲明以來,JPEX從未與證監會接觸。JPEX的聲明以及對客戶提款的所謂安排或要求,全屬JPEX自行作出。

事件曝光後,至少數百位投資者求助無門,一眾「網紅」與JPEX割席。以往積極透過舉辦投資班招攬網民註冊JPEX的林作,周五就事件主動到警署提供資料,稱希望能追到資金源,並協助客人在該交易平台追討損失。他強調跟平台無直接接觸,亦找不到負責人,又謂自己亦損失慘重。

JPEX疑涉詐騙已轉介警方調查

港聞

2023-09-16

證監會澄清從未與其接觸 指其加提幣手續費安排屬自行決定

香港證監會於本周三點名批評虛擬資產交易平台JPEX無申領牌照後,有用戶投訴無法提取資金,有用戶更指JPEX將提款額度最高限制在1,000 USDT(美元穩定幣),但手續費高達999USDT。JPEX前晚稱,已調整提幣手續費及階段性開放提幣上限,而平台已成立專案小組,正等待證監會回覆進一步指引云云。證監會昨日反駁,JPEX這兩天並未與會方接觸,而有關提款安排全屬JPEX自行決定。由於事件可能涉及詐騙,證監會已轉介警方調查。警方昨日呼籲涉及該平台的設訴人士,可經電子報案平台舉報,商罪科會合併處理。

網上昨日傳出有JPEX用戶一度無法提款,而提幣上限被設定為1,000 USDT(相當於1,000美元),手續費卻高達999 USDT(相當於999美元),變相只可提走1美元,也有投資客戶報稱在平台要求提幣失敗,已向警方報案。JPEX前晚聲稱,鑑於證監會13日發出的聲明,已逐步調整提幣手續費,並階段性開放提幣上限,如果用戶有緊急的提幣需求,可以填寫表格,以申請優先的提幣排序。

JPEX稱將成立專案組跟進

JPEX又聲稱,將成立由法律界、金融界人士組成的專案小組,商討未來發展方向,將等待證監會回覆進一步指引。

證監會昨日表示,自9月13日就JPEX發出警告聲明以來,JPEX從未與證監會接觸,JPEX的聲明及對客戶提款的所謂安排或要求,全屬JPEX自行作出。

證監會強調,JPEX旗下的實體一概沒有獲證監會發牌,迄今亦無向證監會申領在香港經營虛擬資產交易平台的牌照。由於事件可能涉及詐騙,證監會已將事件轉介警方,並會協助警方調查。

警方發言人昨日證實,14日已接獲證監會轉介,商業罪案調查科正跟進事件,呼籲所有關於證監會聲明中的虛擬資產交易平台的投訴,可經電子報案方式向警方舉報,商業罪案調查科將會一併處理,市民如有查詢,可致電24小時熱線2860 5012。

據證監會在13日的警告聲明中指,JPEX沒有獲證監會發牌,亦沒有申請牌照,留意到JPEX透過社交媒體網紅及場外虛擬貨幣找換店,積極向香港公眾推廣該平台的服務和產品,列出六大可疑手法,當中涉及作出虛假或具誤導性的陳述。證監會強調,已通知網紅及場外找換店,要求停止推廣。

代言人張智霖:保留追究權利

早前聲稱已申請成為「JPEX合夥人」及開辦投資講座的「網紅」林作,昨日透過律師主動聯絡警方,他辯稱任何人都可成為「所謂平台合夥人」,而自己是在類似代言人、代理人的情況下為該平台宣傳,但絕非該平台一員,亦和JPEX沒有任何直接合作或接觸,也無法找到其負責人,又稱自己已到灣仔警署主動向警方提供線索,協助受影響人士。

任JPEX代言人的張智霖,其經理人在回覆傳媒查詢時表示,在去年中完成拍攝有關的廣告後,已書面通知JPEX在香港未取得牌照前不能使用張的肖像宣傳,會保留追究JPEX的權利。

Securities and Futures Commission(香港证券及期货事务监察委员会)

Warning statement on unregulated virtual asset trading platform

13 Sep 2023

The Securities and Futures Commission (SFC) is aware that a virtual asset trading platform (VATP) known as “JPEX” has been actively promoting its products and services to the Hong Kong public through social media influencers and key opinion leaders (KOLs) as well as over-the-counter virtual asset money changers (OTC Shops) (Note 1).

The SFC wishes to make it clear that no entity in the JPEX group is licensed by the SFC or has applied to the SFC for a licence to operate a VATP in Hong Kong.

The SFC has also observed a number of suspicious features about the practices of JPEX and those actively promoting it to the Hong Kong public:

(a) JPEX states on its website that it is “a licensed and recognised platform to facilitate the trading of digital asset and virtual currency”. It claims on its website and local advertorials to have obtained licences from certain overseas regulators to operate VATP, which is in fact not true (Note 2).

(b) JPEX offers very high returns for some of its products (Note 3).

(c) The SFC has received complaints from, and notes that there have been media reports of, retail investors who were unable to withdraw virtual assets from their accounts maintained with JPEX, or had found their account balances having been reduced and altered.

(d) Some of the products offered by JPEX appear to be arrangements involving virtual assets such as virtual asset “deposits”, “savings” or “earnings” which are not allowed under the SFC’s regulatory regime for VATPs (Notes 4 and 5).

(e) JPEX publicised on its website and local advertorials that it had entered into a business cooperation with and received investment from a Hong Kong listed company, when, in fact, the cooperation has already been terminated and no investments were actually made by the listed company.

(f) KOLs and OTC Shops have made false or misleading statements on social media to suggest that JPEX has applied for a VATP licence in Hong Kong, either independently or in partnership with a Hong Kong listed company, when in fact no entity in the JPEX group has submitted any VATP licence application to the SFC.

The SFC has notified the relevant KOLs and OTC Shops of the SFC’s suspicions and concerns and requested them to cease promoting JPEX and its related services and products.

Under section 53ZRF of the Anti-Money Laundering and Counter-Terrorist Financing Ordinance (AMLO), a person commits an offence if the person, directly or indirectly, in a transaction involving any virtual assets: (i) employs any device, scheme or artifice with intent to defraud or deceive, or (ii) engages in any act, practice or course of business that is fraudulent or deceptive, or would operate as a fraud or deception (Note 6).

Under section 53ZRG of the AMLO, a person commits an offence if the person makes any fraudulent misrepresentation or reckless misrepresentation for the purpose of inducing another person to enter into, or offer to enter into, an agreement to acquire, dispose of, subscribe for or underwrite any virtual assets (Note 7).

The SFC is also empowered by section 53ZTH to take action against any persons who are knowingly or unknowingly involved in contravention-related conduct under the AMLO.

The SFC will not hesitate to take enforcement action against individuals and entities who fail to abide by the VATP regime administered by the SFC, including those who are involved in such violations.

The SFC takes this opportunity to warn investors to be cautious about investment opportunities that seem too good to be true. Investors should be sceptical of investment advice posted on social media platforms and instant messengers by KOLs who are often paid promoters but not investment professionals.

Once again, the SFC warns investors to be wary of the risks of trading virtual assets on an unregulated VATP. Investors may risk losing their entire investment held on the VATP if it ceases operation, collapses, is hacked or otherwise suffers from any misappropriation of assets. Seeking recourse against platforms that do not have a nexus with Hong Kong is likely to be difficult and legal remedies may not be available. If in doubt about the licensing status of any VATP, please refer to the SFC’s list of licensed virtual asset trading platforms.

Notes:

- JPEX is a VATP operating at the website of jp-ex.io, which has been placed on the SFC’s Alert List since 8 July 2022.

- While JPEX is registered as a business or entity with certain overseas regulators, these registrations do not constitute approval or licences to allow virtual asset trading services to be legally provided in those jurisdictions. JPEX claims on its website that its operating headquarters is located in Dubai and under the supervision of the Virtual Assets Regulatory Authority of Dubai (VARA), its trading system “has stricter regulatory standards and more transparency and openness in cross-border transactions”, but JPEX is not on the public list of licensed virtual assets service providers published by VARA.

- For example, as at 12 September 2023, JPEX’s savings product offered 21% annual percentage yield (the rate of interest/return earned in one year) for ETH, 20% for BTC and 19% for USDT according to its website at jp-ex.io.

- Paragraph 7.26(b) of the Guidelines for Virtual Asset Trading Platform Operators provides that a platform operator should not make any arrangements with its clients on using the client virtual assets held by the platform operator or its associated entity with the effect of generating returns for the clients or any other parties.

- Pursuant to section 53ZRK of the AMLO, the SFC may grant a licence to an applicant only if the SFC is satisfied, among other things, that the applicant is a fit and proper person to be licensed for the virtual asset trading service. If JPEX makes any application for a VATP licence, the SFC will take into account whether it has been involved in providing services and products that may not comply with the applicable legal and regulatory requirements, whether its involvement in such activities could have reasonably been avoided and whether it can demonstrate a genuine intention to rectify non-compliant activities, including gradually unwinding impermissible transactions in an orderly manner, all of which reflect the applicant’s ability to provide the virtual asset trading service competently, honestly and fairly. The SFC takes a dim view of any continued promotion of non-compliant activities.

- A person who commits this offence is liable: (i) on conviction on indictment, to a fine of $10,000,000 and to imprisonment for 10 years; or (ii) on summary conviction, to a fine of $1,000,000 and to imprisonment for three years.

- A person who commits this offence is liable: (i) on conviction on indictment, to a fine of $1,000,000 and to imprisonment for seven years; or (ii) on summary conviction, to a fine at level 6 and to imprisonment for six months.

Page last updated 13 Sep 2023

发表回复