Welcome to Day Four

We’ve now reached the end of the first week of the trial. The (dwindling number of) reporters at the courthouse have started a sign-in sheet, after people cutting in line meant that some who arrived early weren’t able to get a spot in the actual room. We have no lunch break today and are ending around 2pm ET, partly to accommodate a juror who needed to reschedule a flight.

FTX CTO Gary Wang is up again this morning; if there’s time, we may hear from BlockFi’s Zac Prince or Pinecone’s Elan Dekel but it’s possible the week will end with Wang. Judge Kaplan has been very respectful of the jury’s time so far and we’re unlikely to run late today.

There’s no word yet on when the other cooperating witnesses, FTX director of engineering Nishad Singh and Alameda Research CEO Caroline Ellison, will testify.

Before the morning session gets underway, let’s recap yesterday’s testimony from Adam Yedidia, an ex-FTX developer and long-time associate of Bankman-Fried.

Yedidia testified to the lavish conditions in which Bankman-Fried and other FTX employees lived, in a luxury resort in the Bahamas called The Albany. But more importantly, he spoke to the blurriness of the boundaries between FTX and its sibling company, Alameda Research, which served to enable the alleged fraud.

He described an arrangement whereby customers depositing funds onto the FTX exchange, unbeknownst to them, had been delivering money to a bank account under the control of Alameda. This arrangement arose because FTX “had trouble opening its own bank account,” said Yedidia, but resulted in a situation in which Alameda effectively owed up to $8 billion to FTX customers.

It would later become clear that, instead of holding onto it for safekeeping, Alameda had used the money to repay loans and for various other purposes.

After Yedidia, the prosecution brought Matt Huang to the stand. Huang is the founder of Paradigm, a crypto investment firm that took a stake in FTX.

Huang spoke to the ways prospective investors were allegedly misled by Bankman-Fried about the relationship between FTX and Alameda, which was also a customer of the FTX exchange. When FTX was pitching for investment Paradigm was “told that there was no preferential treatment for Alameda,” said Huang.

But in practice, the prosecution claims, Alameda was exempted from various protections designed to prevent customers from racking up large amounts of debt, increasing the risk of financial trouble at FTX. The implication is that Bankman-Fried defrauded investors by failing to inform them of certain arrangements that might have raised concern.

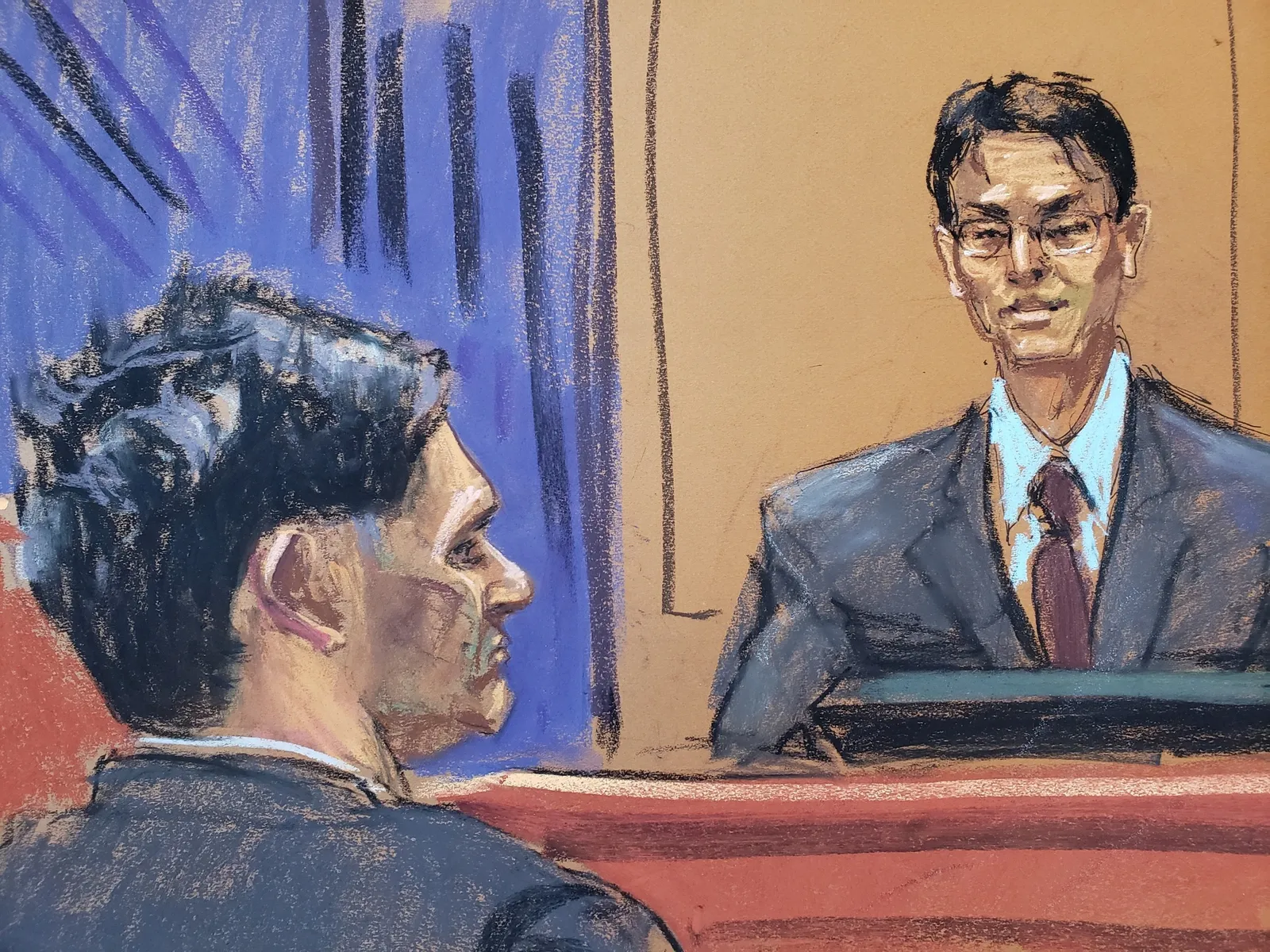

Next up was FTX co-founder and CTO Gary Wang, pictured in the sketch below, right, whose testimony continues today. Wang didn’t have long on the stand before the end of play and the standout exchange came early on:

Prosecution: “Did you commit financial crimes while working at FTX?”

Wang: “Yes.”

Prosecution: “What types of crimes did you commit?”

Wang: “Wire fraud, securities fraud, and commodities fraud.”

Prosecution: “Did you commit these crimes by yourself or with other people?

Wang: “With other people.”

Prosecution: “Who were the main people you committed these crimes with?”

Wang: “Sam Bankman-Fried, Nishad Singh, and Caroline Ellison.”

The Trial’s Recurring Themes

In the first week, witnesses have been asked about a handful of topics whose relevance to the charges against Bankman-Fried might not immediately be apparent. It’s about establishing the character and motivations of Bankman-Fried.

Signal and message auto-deletion: The prosecution has emphasized that Bankman-Fried instructed staff to communicate over Signal, an encrypted messaging app that allows messages to be deleted automatically after a certain period. The implication, presumably, is that he knew he had something to hide. But the defense says that the approach was “reasonable.”

In traditional finance, practically all internal and external communications must be logged as a legal requirement. But crypto is largely unregulated and the same record-keeping requirements do not yet apply. While a crypto firm like FTX might have the trappings of a regular financial organization, and deal in similar kinds of assets, it’s not a straight comparison.

Crypto exchanges and geofencing: In its cross-examination of ex-FTX employee Adam Yedidia, the defense pointed to steps taken by Bankman-Fried to ensure US-based customers couldn’t access the FTX.com platform, which offered riskier types of trading that requires a special license in the US.

In doing so, it positioned Bankman-Fried as a responsible steward of FTX, concerned with remaining within the bounds of the law. But it also served to contrast Bankman-Fried with other crypto figures that have found themselves in legal trouble, like Changpeng Zhao, Binance CEO, whose exchange has been accused by US regulators of secretly helping US customers to bypass geo-restrictions.

A major challenge for both the prosecution and the defense during this trial will be to make very complex and technical ideas understandable. Yesterday, jurors got an explanation of futures trading from FTX CTO Gary Wang:

“It’s a—it’s a contract where you can either be—you can either buy it or if you buy—or you can short or sell it, short and at some future—at some particular future date, depending upon what future it is, based on what—so for example, for a Bitcoin future, you would have a—it would be a future on Bitcoin and it would settle at some particular date in the future, and at that future time, whoever shorts the future pays whoever is long on the future, whatever the price of Bitcoin is on that date.”

Good luck, jurors.

The Charges Against SBF

Bankman-Fried faces a daunting list of thirteen charges, seven of which will be heard at this, the first of two trials.

Of the seven, most relate to the ways FTX and Alameda allegedly lied to customers, lenders and investors about the nature of the relationship between the two companies and the use of customer funds:

- Conspiracy to commit wire fraud on customers of FTX

- Wire fraud on customers of FTX

- Conspiracy to commit wire fraud on lenders to Alameda Research

- Wire fraud on lenders to Alameda Research

- Conspiracy to commit fraud on customers of FTX in connection with purchase and sale of derivatives

- Conspiracy to commit securities fraud on investors in FTX

- Conspiracy to commit money laundering

In building its charge sheet, says Daniel Richman, professor of law at Columbia University, the government has adopted a “thin to win” approach—including only the minimum amount of information necessary to secure a conviction. The goal, he explains, is to tell a “rich and textured story” that conveys the extent of the fraud, but without overwhelming the jury with technical details. “If you can’t explain in a couple of sentences why all this basically amounts to ripping people off, you’re not going to have an easy trial,” he says.

The defense, as we saw in opening statements, will try to undermine this approach by painting a more complex picture. It will spin a yarn about the “liquidity crisis” at FTX, the complexities of Alameda’s “market making” business and the perils of improperly collateralized loans. These nuances are essential to understanding whether Bankman-Fried has engaged in fraud, the defense will argue.

Today in Court

Today’s session was all Gary Wang and, fitting for a CTO, it was the most technical testimony yet.

Wang had already testified yesterday about the special privileges Alameda allegedly enjoyed, such as trading faster, the ability to have a negative account balance, and the $65 billion line of credit. The prosecution showed bits of code and spreadsheets to drive home how exactly this was apparently done.

Perhaps most damning was the revelation that director of engineering Nishad Singh had built the “allow negative balance” feature and enabled it for Alameda and Alameda only on July 31, 2019, the exact day that Bankman-Fried was tweeting that Alameda’s “account is just like everyone else’s.”

Wang then recounted overhearing a 2019 conversation in which an Alameda trader asked SBF about the borrowing privileges. Bankman-Fried allegedly said it was fine, as long as the amount that Alameda withdrew was less than FTX’s total revenue, which at the time was about $50 to $100 million. Soon, Alameda’s borrowing exceeded FTX’s revenue. Near the end of the year, Wang brought up these concerns to Bankman-Fried, who then asked if he was including the fact that Alameda owned a lot of FTT, FTX’s own tokens.

Wang’s testimony made clear that Alameda was treated differently in many ways: other companies with a line of credit couldn’t withdraw off the platform and the credit had to be used for collateral but this was not true for FTX. Over time, the line of credit extended to Alameda grew from $1 million to $1 billion to, finally, $65 billion. Other companies who received a line of credit were allowed amounts in the double-digit millions only.

The prosecution also pulled up tweets claiming that FTX had a $100 million insurance fund. This, Wang said, was untrue and not a real number. When an account exploited a loophole to post only a little collateral but hold large positions, SBF ordered that Alameda take on that account because FTX’s balance sheets were more public than Alameda’s.

By September 2022, Wang said a forthcoming Bloomberg article about the close relationship between FTX and Alameda had SBF sending him and Singh (but not Ellison) a Google Doc with arguments for shutting down Alameda. Wang claimed he pointed out that Alameda actually could not shut down because there was no way of repaying its debt.

In November, after the company filed for bankruptcy, Wang accompanied SBF to turn over remaining assets to the Bahamian authorities. SBF had told Wang to ignore legal instructions to not hand over the assets to the Bahamian authorities, Wang claims. Bankman-Fried thought that the authorities in the Bahamas seemed more friendly and were more likely to let him stay in control of the company, Wang added.

The first week of the trial of Sam Bankman-Fried has come to a close. The court is closed Monday for Indigenous Peoples’ Day. The trial resumes on Tuesday morning. The next witness? Caroline Ellison.

Thanks for reading.

Gary Wang, an FTX Founder, Says Sam Bankman-Fried Steered Misuse of Funds

Mr. Wang is one of three key witnesses who pleaded guilty and agreed to cooperate against Mr. Bankman-Fried, the onetime crypto mogul on trial for fraud.

Oct. 6, 2023

Updated 4:54 p.m. ET

Gary Wang, a former top executive of the failed FTX cryptocurrency exchange, testified that Sam Bankman-Fried, the company’s founder, was the final decision maker at the firm and directed a closely related hedge fund to misuse as it pleased billions of dollars in money from FTX customers.

Over more than six hours of testimony in federal court in Manhattan on Thursday and Friday, Mr. Wang said Mr. Bankman-Fried was fully aware that a sister cryptocurrency trading firm, Alameda Research, had siphoned off $8 billion in customer money from FTX. He said Mr. Bankman-Fried had lied in his public statements in November about FTX customer assets being safe and secure.

Mr. Bankman-Fried called the shots on big issues at FTX, Mr. Wang told the jury of nine women and three men. “In the end, it was Sam’s decision,” he said.

Mr. Wang, 30, who was also a founder of FTX and programmed its code base, is a crucial witness in Mr. Bankman-Fried’s high-profile criminal fraud trial. Mr. Wang is one of Mr. Bankman-Fried’s three close advisers who have pleaded guilty and agreed to cooperate against the entrepreneur, who has been charged with orchestrating a conspiracy to use as much as $10 billion of FTX customer money for all manner of personal projects.

The saga of FTX’s rise and fall has gripped the public for months with its mixture of corporate hubris and personal intrigue. Since the exchange collapsed in November, Mr. Bankman-Fried has become a symbol of the crypto industry’s excesses, and his trial is seen by some as a credibility test for the digital currency industry.

A run on deposits last year exposed an $8 billion hole in FTX’s accounts, which prosecutors allege stems in large part from “special privileges” that allowed Alameda to tap into FTX customer money. FTX filed for bankruptcy and Mr. Bankman-Fried was charged a month later with wire fraud, securities fraud, money laundering and related conspiracy charges. He has pleaded not guilty and faces what could amount to a life sentence if convicted.

Within weeks of FTX’s implosion, Mr. Wang, a friend of Mr. Bankman-Fried’s from high school math camp, pleaded guilty to aiding him in that conspiracy. Nishad Singh and Caroline Ellison, two other top executives in Mr. Bankman-Fried’s business empire, have also pleaded guilty and are cooperating with prosecutors.

Mr. Wang and Mr. Singh, who also programmed the code underlying FTX’s business, have admitted to creating a secret backdoor that allowed Alameda to borrow a virtually unlimited amount of money from the exchange. Prosecutors have argued that this backdoor was one of the primary engines of the scheme to pilfer customer accounts.

Mr. Bankman-Fried’s legal team has argued that FTX and Alameda had an appropriate business relationship and “were not set up to create some grand fraudulent scheme.”

In court on Thursday and Friday, Mr. Wang walked the jury through FTX’s early days in 2019 to its stunning collapse last year.

Mr. Wang said that he and Mr. Singh had written FTX’s computer code to grant Alameda special privileges at Mr. Bankman-Fried’s direction beginning in 2019. “He asked us to do it, and we told him we did it,” Mr. Wang said.

That effectively allowed the trading platform to make unlimited withdrawals from the exchange, he said. None of that was disclosed to customers, investors or lenders to the firms, he added.

“We gave special privileges to Alameda Research on FTX,” Mr. Wang said. “And we lied about this to the public.”

Alameda at first was allowed to take out only as much as FTX’s revenue from trading fees, which was about $300 million at the time, Mr. Wang said. But that credit line increased over time, growing to tens of billions of dollars, he said. Mr. Bankman-Fried said he had no issues with this, Mr. Wang said.

Since FTX imploded, Mr. Bankman-Fried has repeatedly said he was only vaguely aware of the amount that Alameda was borrowing from the exchange. But Mr. Wang testified that Mr. Bankman-Fried had Alameda’s balance visible on one of his computer screens at the office. Mr. Wang said that he, Mr. Bankman-Fried, Mr. Singh and Ms. Ellison discussed the money that Alameda owed at a meeting in June 2022.

At the end of the meeting in FTX’s office in the Bahamas, Mr. Wang said, Mr. Bankman-Fried turned to Ms. Ellison and told her she could use more customer funds to pay back Alameda’s creditors.

Under cross-examination, Mr. Wang said some special privileges that Alameda had were part of its role as a trading partner to enable FTX customers to freely buy and sell cryptocurrencies. He is scheduled to answer more questions from defense lawyers when the trial resumes on Tuesday.

Mr. Wang and Mr. Bankman-Fried were classmates at the Massachusetts Institute of Technology before founding FTX together in 2019.

Like Mr. Bankman-Fried, Mr. Wang became enormously rich, with an estimated net worth of nearly $5 billion. Within FTX, he and Mr. Bankman-Fried were regarded as opposites. While Mr. Bankman-Fried was the garrulous pitchman, Mr. Wang was the shy coder who showed up for work in the middle of the afternoon and labored through the night.

They were also close friends who lived together with eight other roommates in a luxury penthouse in the Bahamas, where FTX was based. That relationship ended in December when Mr. Wang pleaded guilty to federal fraud charges, saying he knew “what I was doing was wrong.”

Before Mr. Wang took the stand, lawyers questioned a witness who was one of Mr. Bankman-Fried’s M.I.T. classmates, Adam Yedidia. Mr. Yedidia, who worked as a developer at FTX, recounted a conversation he had with Mr. Bankman-Fried in mid-2022, months before FTX failed, in which the founder admitted that his firm was on shaky footing.

“Sam said something like, ‘We were bulletproof last year, but we’re not bulletproof this year,’” Mr. Yedidia said. He said Mr. Bankman-Fried explained that it could take six months to three years to make the company “bulletproof again.”

Mr. Yedidia was followed on the witness stand by Matt Huang, a founder of Paradigm, a venture capital firm that was one of FTX’s biggest backers. Mr. Huang said he would have had qualms about authorizing investments in FTX if he had known the full extent of the exchange’s relationship with Alameda.

发表回复