PRESS RELEASE

Michigan Man Sentenced to Prison for Check-Kiting Scheme that Caused Loss of Nearly $150 Million

Thursday, November 2, 2023

For Immediate Release

U.S. Attorney’s Office, Northern District of Ohio

CLEVELAND –Najeeb Khan, 70, of Edwardsburg, Michigan was sentenced to 97 months imprisonment by U.S. District Court Judge Pamela A. Barker after earlier pleading guilty to bank fraud and attempted tax evasion. Judge Barker also ordered Khan to pay over $150,000,000 in restitution to the victims of his bank fraud and the IRS, and to serve 3 years of supervised release once released from prison.

According to court documents, Khan owned and operated Interlogic Outsourcing Inc. (“IOI”), a payroll processing company that, at one point, provided services to approximately 6,000 clients.

Beginning in 2014, however, Khan operated a check-kiting scheme using his company’s business bank accounts to fraudulently obtain funds from various financial institutions, including KeyBank. Khan used these funds to support the growth of his payroll processing business and fund his lifestyle, which included the purchase of automobiles, aircraft, and vacation homes.

As part of his scheme, Khan wrote checks and made wire transfers between multiple accounts under his control at various banks. This type of fraud is commonly known as check-kiting, and it involves the perpetrator continually writing checks back and forth between accounts he or she controls to fraudulently inflate account balances, thus deceiving banks into honoring checks written with insufficient funds.

Khan wrote checks from IOI accounts at Lake City Bank for deposit into IOI accounts at KeyBank and then wrote checks from IOI accounts at Berkshire Bank for deposit into IOI accounts at Lake City Bank. To cover the check funds issued from Berkshire Bank, Khan wired funds from IOI accounts at KeyBank to IOI accounts at Berkshire Bank.

This long-running check-kiting scheme caused a financial loss of nearly $150 million to businesses around the country and to KeyBank in the Northern District of Ohio. Khan also failed to report income gained from the check-kiting scheme on his annual tax return for the tax years 2014 to 2017.

“This defendant essentially gave himself a $150,000,000 loan, spent money however he wanted on himself and his business, then defaulted, all without ever getting the banks’ approval to give him that loan,” said U.S. Attorney Rebecca C. Lutzko. “These types of financial crimes undermine the well-being of our financial institutions and harm our entire community. This office will vigilantly investigate and prosecute persons who engage in such conduct to protect and prevent harm to financial institutions locally and nationwide.”

“Financial crimes can have serious and long-term consequences. Complex financial crimes that impact the economic well-being of institutions is reprehensible,” said FBI Cleveland Special Agent in Charge Gregory Nelsen. “The defendant orchestrated an elaborate business fraud scheme that caused extensive monetary harm to financial institutions nationwide. The FBI will work diligently and seek justice for individuals and entities who fall victim to conniving criminals who cheat and lie for the sole purpose of personal gain.”

This case was investigated by the Cleveland FBI and IRS Criminal Investigations (“CI”). This case was prosecuted by Assistant U.S. Attorneys Chelsea S. Rice and Alejandro A. Abreu.

Contact

Thomas P. Weldon

Thomas.Weldon@usdoj.gov

(216) 622-3651

Updated November 2, 2023

Former CEO of Elkhart payroll company sentenced to 8 years for $150 million scheme

Published: 10:26 a.m. ET Nov. 3, 2023 Updated: 10:27 a.m. ET Nov. 3, 2023

Najeeb Khan, 70, of Edwardsburg, was sentenced to eight years in prison after pleading guilty to bank fraud and attempted tax evasion.

Khan was sentenced Thursday by U.S. District Judge Pamela A. Barker in Cleveland. Khan also was ordered to pay $150 million in restitution to the victims of his bank fraud and the IRS as well as three years of supervision following his release from prison.

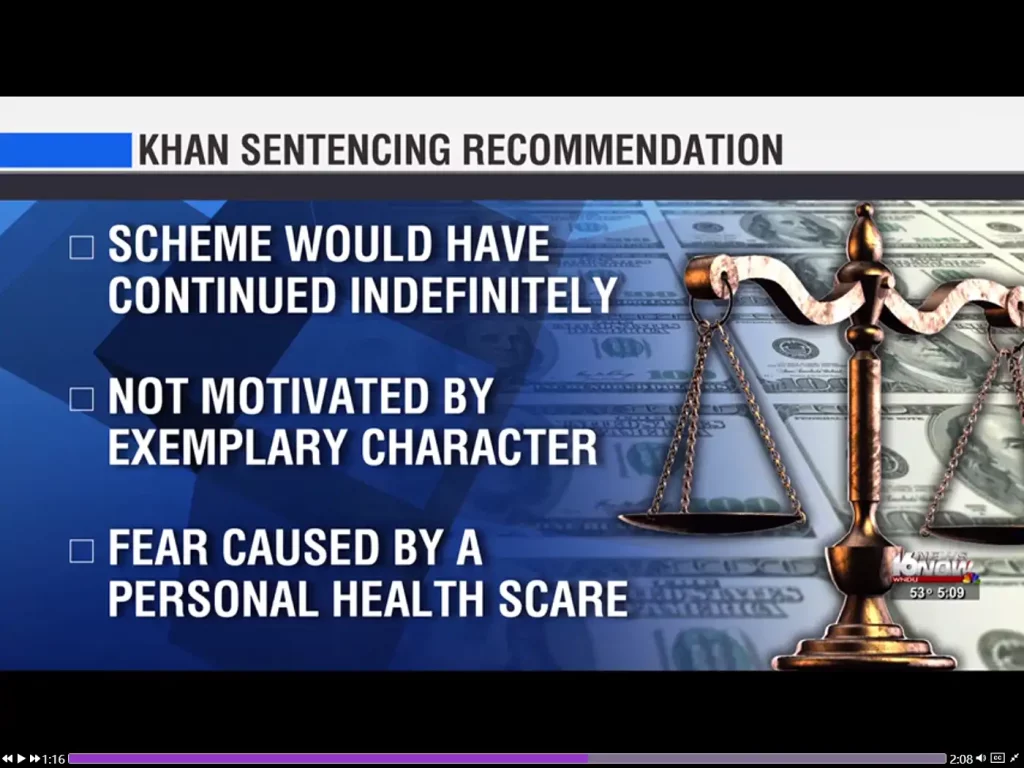

Khan’s attorneys asked for a sentence of 18 to 24 months in prison, saying anything over five years could amount to a death sentence.

Khan pleaded guilty earlier this year and was awaiting sentencing. He was the former owner of Interlogic Outsourcing Inc. (IOI), a payroll processing company based in Elkhart that at one point provided services to about 6,000 clients.

Beginning in 2014, Khan operated a check-kiting scheme using his company’s business bank accounts to fraudulently obtain money from various financial institutions, including KeyBank.

Khan used the money to support the growth of his payroll processing business and pay for a lavish lifestyle, which included the purchase of automobiles, aircraft and vacation homes, according to court documents.

As part of his scheme, Khan wrote checks and made wire transfers between multiple accounts under his control at various banks. This type of fraud is commonly known as check-kiting, and it involves the perpetrator continually writing checks back and forth between accounts he or she controls to fraudulently inflate account balances, thus deceiving banks into honoring checks written with insufficient funds.

Khan wrote checks from Interlogic accounts at Lake City Bank for deposit into IOI accounts at KeyBank and then wrote checks from IOI accounts at Berkshire Bank for deposit into IOI accounts at Lake City Bank. To cover the check funds issued from Berkshire Bank, Khan wired funds from IOI accounts at KeyBank to IOI accounts at Berkshire Bank.

The check-kiting scheme caused a financial loss of more than $150 million to businesses around the country and to KeyBank, which is based in Cleveland. Khan also failed to report income gained from the scheme on his annual tax return for the tax years 2014 to 2017.

The scheme might be the “largest and longest-running case of blatant check kiting in United States history,” according to officials.

“This defendant essentially gave himself a $150 million loan, spent money however he wanted on himself and his business, then defaulted, all without ever getting the banks’ approval to give him that loan,” U.S. Attorney Rebecca C. Lutzko said in a release.

The case was investigated by the Cleveland FBI and IRS Criminal Investigations offices.

Because of Khan’s actions, IOI went bankrupt and was purchased in 2019 by PrimePay, a Pennsylvania-based payroll company. Most of Khan’s assets have been auctioned off to try to repay KeyBank and many other businesses that were damaged by the scheme.

Collector cars auctioned:Over 230 ‘Elkhart Collection’ cars, owned by businessman accused of fraud, to be auctioned

In 2020 bankruptcy proceedings, Nancy Khan, who said she had no knowledge of her husband’s activities, was permitted to keep a $1.1 million home and $650,000 guest house in Edwardsburg, several vehicles, a checking account, and retirement fund and several other accounts worth as much as $1 million.

Creditors signed off on the negotiated settlement because, in part, the agreement avoided a costly and time-consuming court fight over those assets, according to documents.

密州商空頭支票詐騙1.8億 判刑97個月

綜合3日電 2023-11-04 02:16 ET

詐欺犯卡恩利用空頭支票前後騙取約1億8000萬元,不法所得除用以支付其奢華生活外,還被用來購買數百輛經典名車。圖為他的汽車收藏。(美聯社)

密西根州一名商人多年來開立空頭支票,總金額約1億8000萬元,並利用不法所得過著奢華生活,購買數百輛經典名車,一躍成為知名汽車收藏家。然而在詐騙案曝光後,他被起訴,並被法官判處逾八年徒刑。

據Cleveland.com報導,密西根州愛德華茲堡(Edwardsburg)70歲商人納吉布·卡恩(Najeeb Khan)除了被判處97個月刑期外,還必須賠償克利夫蘭凱伊銀行(Key Bank)約1億2100萬元、償還客戶2700萬元以及繳清980萬元欠稅。

卡恩於2011年至2019年間,在印第安納州埃克哈特(Elkhart)趁著為客戶承辦薪資業務之際,趁機開立空頭支票進行一連串詐騙行為,並在資金不足情況下,透過三家銀行轉出數十張甚至數百張支票,匯出大筆匯款,並對外誇大個人帳戶金額,趁機挪用約7300萬元資金。

卡恩將詐騙所得用來支付奢侈生活,包括昂貴的旅行、亞利桑納州和密西根州的豪宅、佛羅里達州和蒙大拿州的物業,甚至購買私人飛機、遊艇和直升機,並大肆搜購250多輛經典名車,收藏品包括法拉利(Ferraris)、菲亞特(Fiats)和捷豹(Jaguars)的多款骨董汽車。

卡恩在犯行曝光後,向聯邦法官坦承自己「被貪婪蒙蔽雙眼」,對於銀行詐欺和逃稅等罪名指控,一一認罪;辯護律師也表示,卡恩協助被害者取回部分被騙資金,其中一部分是透過出售名下名車,這些汽車在拍賣會上拍出約4000萬元價格。

不過檢察官表示,卡恩經營的公司盜領客戶的員工薪資與稅金,導致約1700家中小企業、非營利組織以及慈善機構受害,其中包括「美國童子軍」(Boy Scouts of America)和4家天主教教會。

檢察官強調,受害者事後還必須自掏腰包向國稅局繳稅或支付員工薪資,同時因為財務吃緊,不得不申請貸款、被迫解雇員工,以度過難關。

发表回复